Israel is currently going through an extremely challenging period, perhaps the most difficult since I arrived in Israel over 30 years ago. During such a challenging time, I want to express my hope for the swift return of all hostages, the defeat of Hamas, and the safe return of all soldiers.

In times like these, it’s important to continue focusing on routine matters. Therefore, I have chosen to write several posts and updates about companies that I find very interesting. In the stock market, it is also a challenging period, with small stocks seemingly uninteresting, while good reports are ignored, and mediocre reports result in extreme declines.

I have decided to write about three companies that I have been holding for some time and also present an interesting new idea for a company traded in Israel, but with most of its sales in the East and the United States.

In the upcoming posts, I will write about more companies and share thoughts on the market. I hope you find value in the content.

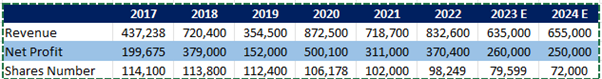

PLUS500 – Trades on the London Stock Exchange with an approximate market capitalization of $1.5 billion, the company holds around $875 million in net cash. While not all cash can be distributed, I believe that at least $400 million is surplus. In the past few years, the company has operated with a much lower net cash of around $300 million. In other words, Plus500 currently trades at a P/E of 2 excluding cash and around a P/E of 4 excluding surplus cash while the company aggressively buys back its own stocks.

Additionally, the company has initiated operations in the US, introducing a new trading platform for retail customers in the US futures markets, forming the Group’s B2C business in the US. The company has also obtained a license to operate in the Emirates, which is expected to be a strong geographical area for the company’s operations.

If we look at the last six years of operations, excluding the extraordinary year of the Covid pandemic, the company has achieved a net profit of around $300 million per year. Even in 2023, which seems to be the less volatile year, Plus500 is expected to make a net profit of $250 million.

The question naturally arises: why is this the situation? I believe that the main reason the company is less attractive to investors as it is not growing significantly, the markets is less volatile, when VIX approaching it lowest levels in years, and the company needs to invest to acquire new clients, all while facing regulatory challenges. However, looking at Plus500’s numbers, it appears to be a company capable of ceasing marketing spendings entirely and still making a net profit of $550 million per year for at least 3-4 years.

I personally think Plus500 should trade at around 9 times its representative net profit of $300M, with an additional $500 million surplus, giving the company a value of $3.2 billion or double its current price. If shares do not appreciate in the next few months, it will trade around 1 P/E excluding cash at the end of 2024 that will cause a total absurd. Should be mentioned that Plus 500 was at much less favorable financial and regulatory situation during past decade but still delivered exceptional returns to shareholders

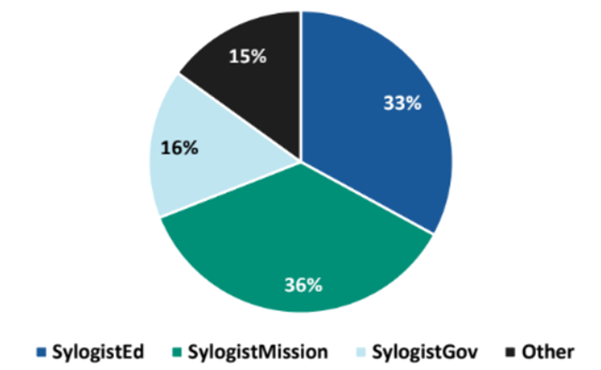

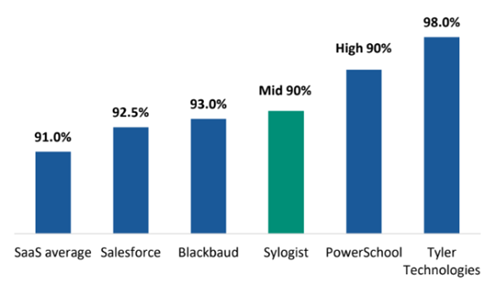

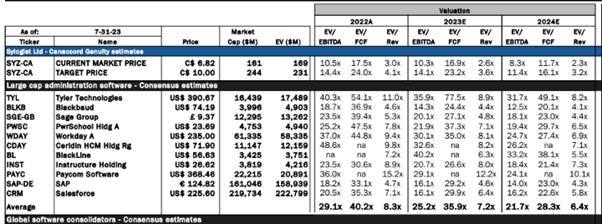

SLYG

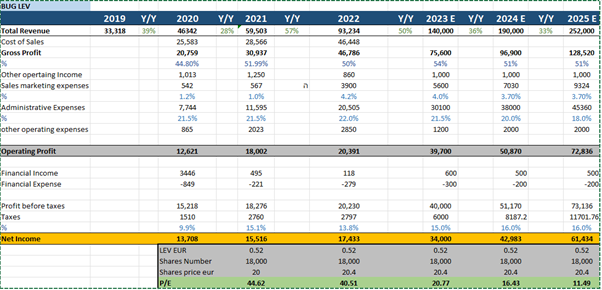

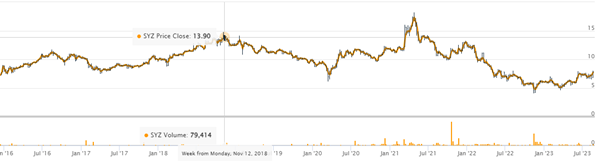

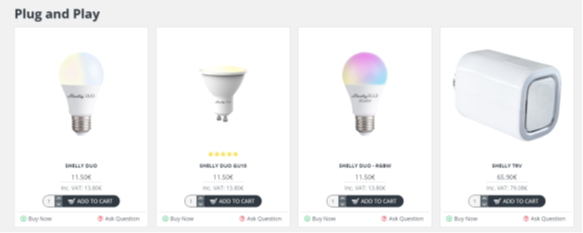

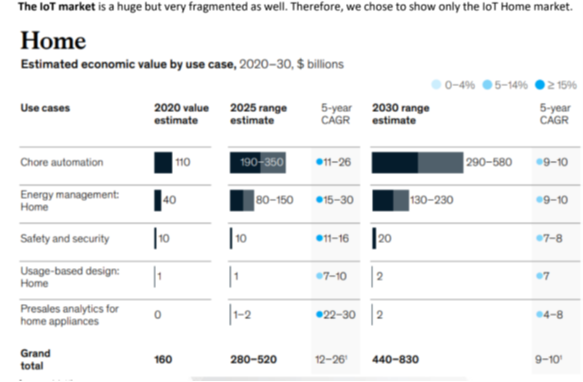

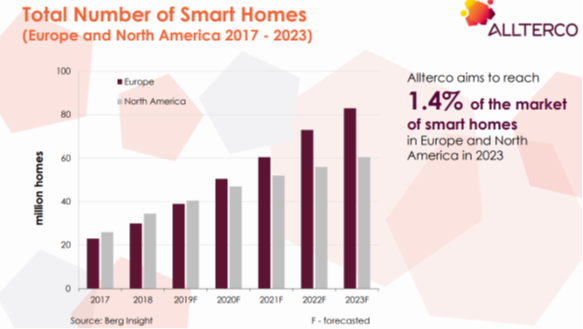

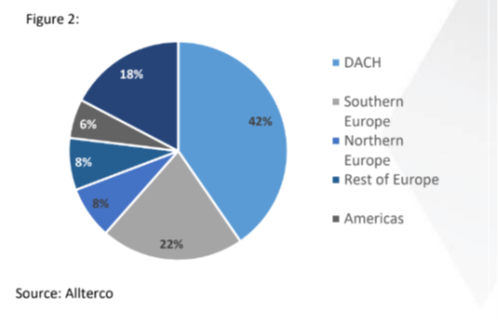

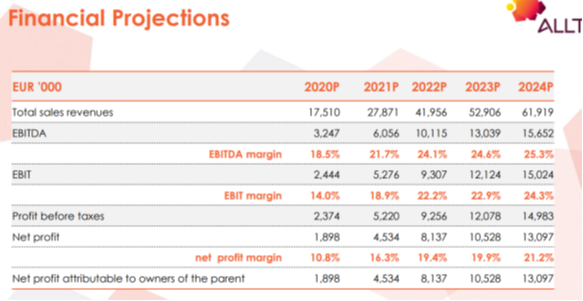

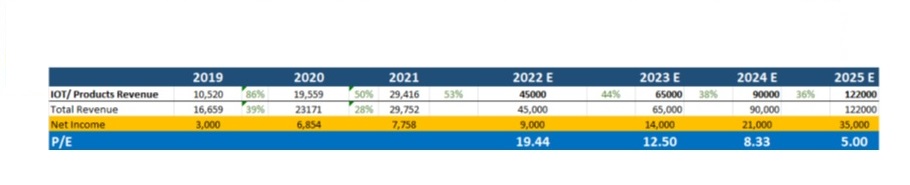

Shelly is still one of my favorite investments despite the significant appreciation at share price over the past year. The company has a highly growing niche, a unique line of products in the IOT market, exceptional management, and a loyal customer base. Shelly presented till now (9M of 2023) impressive results in the not-so-easy market in 2023. In my model, I assumed lower growth than the company’s and analysts’ expectations, lower gross profitability, and still, the company is trading at a P/E multiple of 16 for 2024 and a P/E multiple of ∼11.5 for 2025.

A similar company that comes to mind is XPEL, which has always traded at much higher multiples, even though I personally think Shelly’s business is better, and the optionality is higher.

The company’s advantages lie in its extensive product line, significantly lower R&D costs compared to competitors, a growing market, optionality for SAAS revenue and a founder passionate about the company’s products. There is also a catalyst in the form of Uplisting and the company’s inclusion in a technology index in Germany.

In a few months, the company will be listed on a normal exchange in Germany, and I believe will lead to price appreciation.

During last weeks we saw some big blocks on sale while we didn’t succeed identify who is selling I personally think when those blocks will end shares will appreciate materially

BELFB

A company operating in the field of discrete components, I’ve mentioned it several times on Twitter. Bel Fuse continues to publish excellent reports and trades at significant valuation gaps compared to competitors such as LFUS, CTS, and APH. The company is traded at a simple earnings multiple of 9, while the entire industry is above 20. Surprisingly, BELFB’s verticals are better than those of competitors and less exposed to recession, thanks to high exposure to the defence, railway, and aerospace sectors. The company will also benefit from the global trend of electrification.

It’s important to remember that this year’s multiple doesn’t truly represent since many of Belfb customer still holds lifted inventory which will be cleaned in few months.. When Belfb returns to growth next year and reconstructing costs will disappear, the multiple is expected to decrease even further. Personally, I think Bel Fuse could be a very interesting acquisition target for a potential buyer or a PE fund.

QLTU.TLV – Qualitau Ltd. MC ~80M$

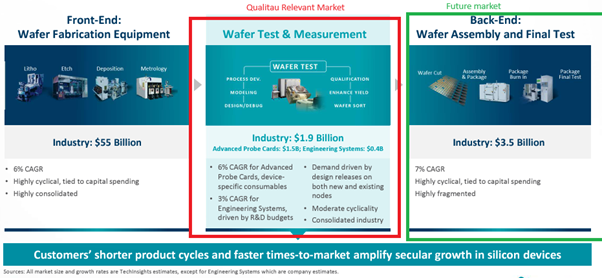

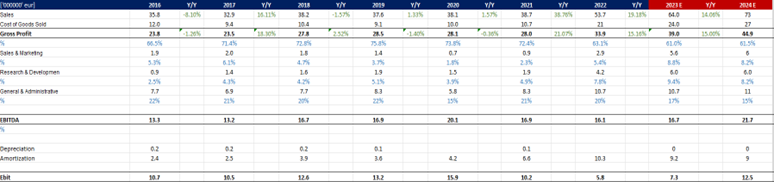

Qualitau Ltd. is a company listed on the Tel Aviv Stock Exchange (TASE) that operates in the semiconductor testing industry. While the company is registered on the Israeli stock market, its primary operations and revenue streams are not directly connected to Israel. With a market capitalization of $80 million, Qualitau is profitable, growing, and operating in one of the interesting fields of semi testing environment

Business Overview: Qualitau specializes in providing testing solutions for semiconductor wafers. The company conducts flow tests to ensure the functionality of individual chips located on wafers. Its clients are private and public companies involved in the manufacturing and design of semiconductor chips. The majority of the world’s chip manufacturers are customers of Qualitau. Additionally, many clients have made repeated purchases of the company’s systems and services.

Despite its relatively small size, Qualitau is considered a global leader in its niche, focusing on testing at the wafer level. At it annual reports Qualitau mentions FORM, a U.S.-based firm with a market capitalization of $3 billion, as one of its main competitors.

Market and Growth: The market for wafer testing equipment is currently valued at almost $2 billion and experiences a growth rate of 5-6% annually.I personally think the growth rates will be much higher in the next few years due to chip act at USA, investments at Japan, and Chips war between nations.

Due to the miniaturization of chips, the quantity of defects in production increases, leading to a higher demand for parameter testing in the wafer fabrication process. Qualitau also begins to operate in the backend market, which is twice the size of the wafer testing market.

Qualitau sells its products in regions such as East Asia, Europe, and the United States, with its manufacturing sites located in the U.S.

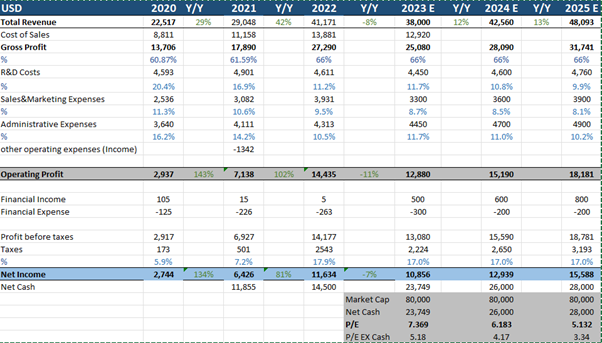

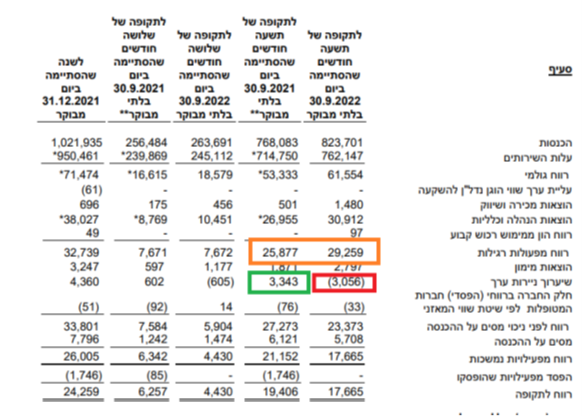

Financials and Valuation: While the company operates in one of the most attractive niches in the semiconductor industry, its multiples present a company at distress or company operates at cyclical environment like coal producers.

Qualitau is currently trading at a P/E of around 7, ex cash P/E of 5 while all semi in world trades at multiples higher than those of S&P500 . The closest competitor, Form, trades at a adjusted P/E around 30 and a normal P/E of 70 while growing much less than Qualitau and with lower gross margins.

So question raised why Qualitau still trades at such valuation?

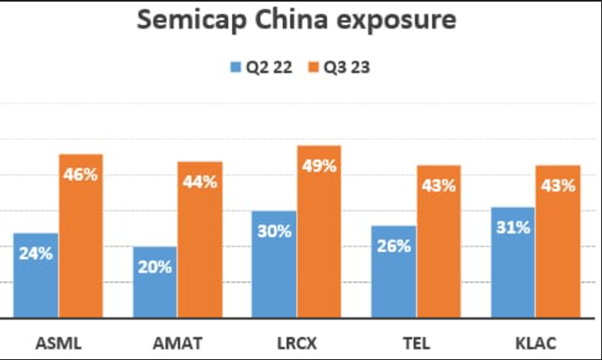

Approximately 60% at 2023 of the company’s revenue comes from China, and the ongoing U.S.-China trade tensions pose a risk to Qualitau’s operations. Some orders was delayed by USA regulator and was released after few weeks. Last order delay caused company to lose around 25% of it market cap in few weeks, only to be announced that orders were approved to deliver few weeks after.

China risk is not unique to Qualitau all semi companies worldwide have such risks but they not trades at net multiple of 5, honestly speaking all semi companies worldwide trades at pretty lifted multiplies.

In addition to the China exposure risk, the company is listed on the Israeli stock exchange, reporting in Hebrew, has low institutional holdings, and most of its investor base consists of private investors and small funds that don’t appreciate its competitive advantages and mostly focus on profit for a specific quarter.

Catalysts for Value Unlocking:

We are pushing the company to publish reports and presentations in English, opening the opportunity for international investors to understand and engage with Qualitau. Additionally, the U.S. government announced a chip act program for bringing back semiconductor manufacturing to the USA, with significant budgets allocated to building fabrication sites. This could serve as a substantial tailwind for Qualitau in the coming years. A recent large order from the U.S was announced few weeks ago and is just the beginning of the tailwinds the company will experience in the next few years when Japan and Europe also increase their budgets.

In addition, we think the company can be a good acquisition target, and based on our checks, some companies have showed interest on it business.

Risks: The primary risk for Qualitau is the potential halt of sales to China. However, this is a global risk affecting all semiconductor companies trading on NASDAQ, and Qualitau’s products, honestly speaking, are not a threat to national security.

Conclusion: Qualitau is currently trading at a P/E multiple of 6 for 2024, with a P/E multiple of 4 after considering the excess cash returning to shareholders in the form of dividends and buybacks. Despite being a niche player, the company is a leader in semiconductor testing, demonstrating growth potential and gross margins exceeding 60%.

Link to company reports Link

We may hold shares at companies mentioned and the research is not a recommendation to act